“Today’s proposal for a Union of Savings and Investments is a double win. Households will have more and safer opportunities to invest in capital markets and grow their wealth. At the same time, businesses will gain easier access to capital for innovation, growth, and the creation of quality jobs in Europe.”

— Ursula von der Leyen,

President of the European Commission

In the context of growing global economic uncertainty, structural demographic challenges, and accelerated digitalization, the European Union aims to strengthen its economic resilience and competitiveness through deeper integration of capital markets. One of the main priorities in this process is the active engagement of citizens as savers and investors, whose role in capital accumulation remains underutilized. Despite relatively high levels of household savings across the EU, their actual contribution to capital markets remains seriously limited, which leads to an undervalued potential for economic growth, innovation, and competitive advantages of European companies compared to the United States and China.

In recent years, the European Commission has placed particular emphasis on the need to create suitable conditions for the entry of individual investors into capital markets, as part of the construction of the Capital Markets Union (CMU). This strategic priority aims not only to facilitate access to financing for businesses but also to encourage citizens to make more effective use of their personal funds through long-term and diversified investments. In this context, individual savers can become a key driver of sustainable development and the innovation capacity of the EU economy.

At the same time, however, the EU faces several serious challenges. Demographic changes—especially the aging population—call into question the long-term stability of pension systems. This necessitates alternative and sustainable forms of security, in which private investments and personal responsibility for financial futures come to the forefront as a crucial tool for reliability and peace of mind. On the other hand, traditional forms of saving, such as bank deposits, offer increasingly low returns in the face of high inflation and market volatility. This further calls into question the effectiveness of saving behavior that is not aligned with actual macroeconomic conditions.

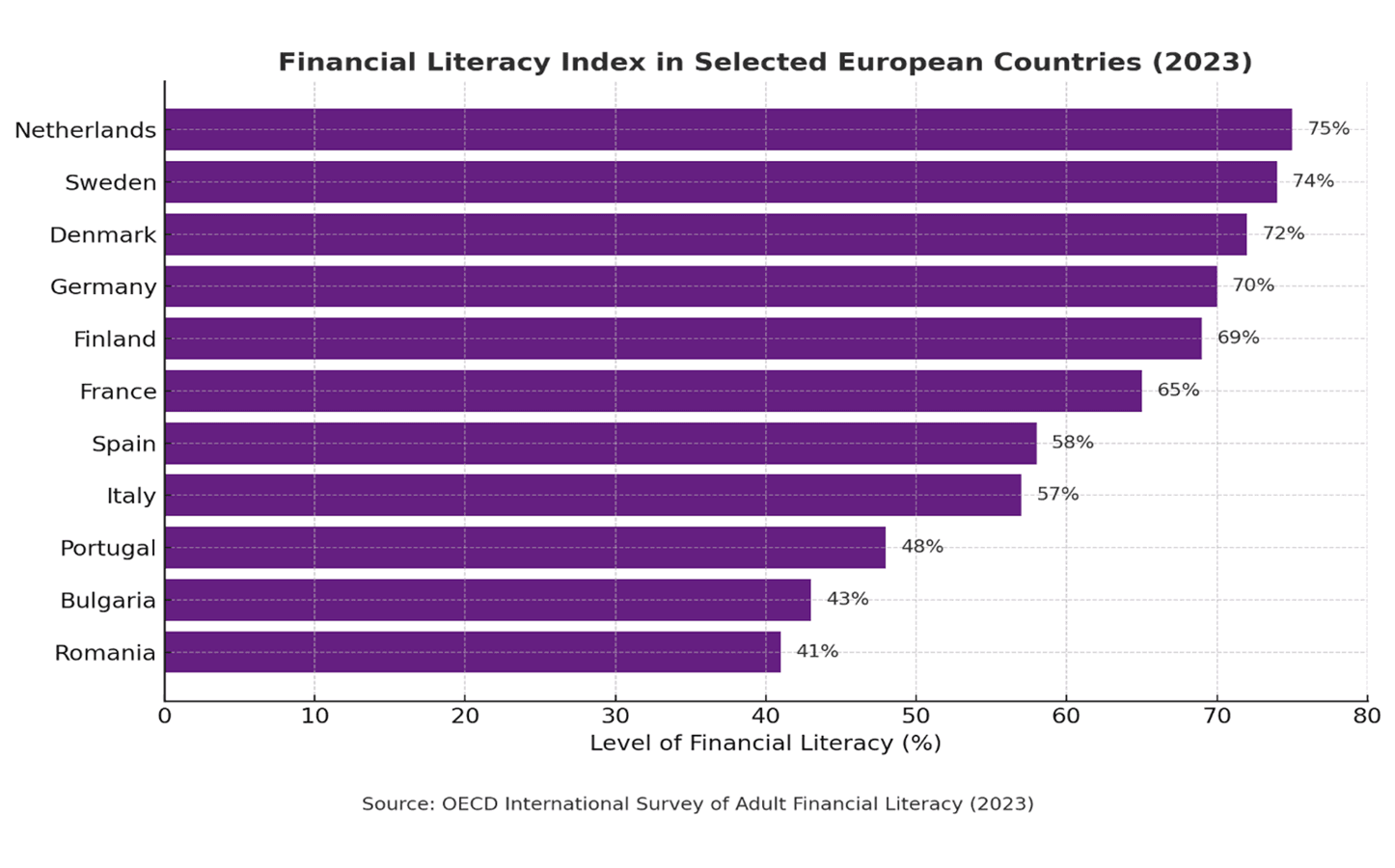

Last but not least is the low level of financial literacy in several Member States, which presents a barrier to the effective participation of citizens in capital markets. According to a Eurobarometer survey from 2023, only 18% of EU citizens demonstrate a high level of financial literacy. Many households lack the necessary knowledge and skills to assess risk, have limited information about the characteristics of financial products, and often fail to understand the benefits of long-term investments. As a result, we are witnessing inequality in access to investment opportunities and increased financial vulnerability across broad social groups.

In a world where inflation erodes savings and traditional pension systems face mounting challenges from an aging population, the individual investor is emerging as a key player in the economic game of the future. The time when money sat passively in bank accounts has passed. Today, conscious and informed management of personal finances is essential—one that combines diversification, financial knowledge, and modern instruments capable of responding to the complex realities of the modern economy.

Moving beyond traditional forms of saving such as deposits and real estate, households must seek active ways to grow their capital, secure their future, and contribute to the creation of sustainable growth. This requires not only financial skills but also supportive policies and market frameworks that understand and respond to people’s evolving needs.

Herein lies both the challenge and the opportunity: how can we transform the average saver into an active investor—one who not only preserves but also grows their financial resources? How can we remove the barriers—lack of trust, low financial literacy, psychological hesitations—and foster the kind of long-term thinking needed to address future economic and social risks? How can the funds of everyday savers be directed toward Europe’s capital markets to support competitiveness, innovation, and the growth of companies in the real economy?

The importance of this issue is further underscored by the fact that the level of social and economic resilience within the European Union is closely tied to the effectiveness of individual financial behavior. Encouraging citizen savings and investments is not only an economic concern but also a matter of public responsibility and long-term vision for sustainable development. Achieving the goals of the Green Deal, digital transformation, and innovation-driven competitiveness demands the active participation of all economic actors—including households.

The European Union faces the significant challenge of mobilizing its resources to achieve its strategic objectives related to long-term competitiveness, security, and the transition to a digital and green economy. In March 2025, the European Commission presented the ambitious “Savings and Investment Union” strategy, aimed at overcoming the long-standing fragmentation of capital markets within the European Union and promoting the transformation of accumulated bank deposits into productive investments. This will enhance the EU’s attractiveness as an investment destination and will be essential for strengthening the Union’s economic competitiveness and strategic autonomy, as highlighted in the conclusions of the European Council and the Eurogroup, as well as in various reports by the European Parliament and statements by leading economists such as Enrico Letta and Mario Draghi.

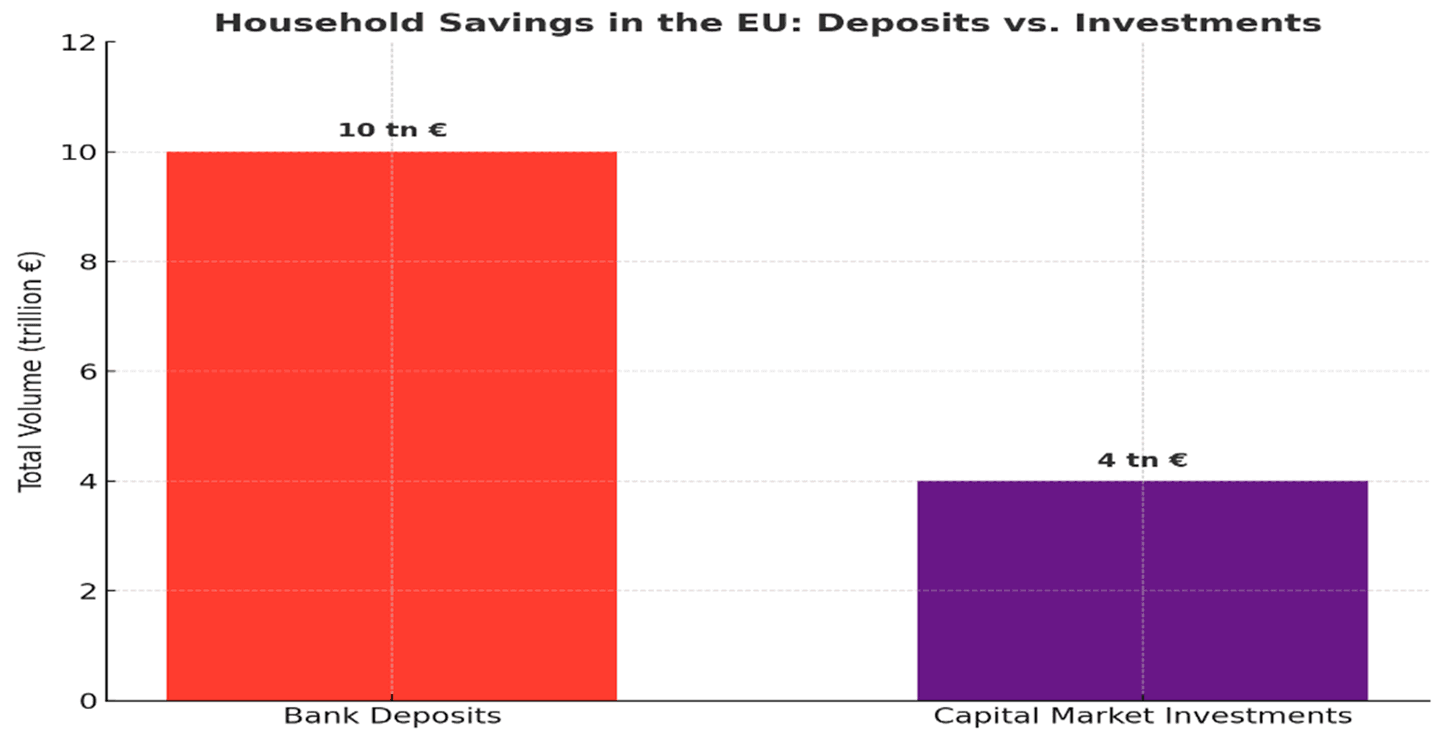

The European Commission’s Competitiveness Report emphasizes that the Savings and Investment Union will be a key pillar in securing the EU’s competitiveness and will play a crucial role in implementing the Union’s main investment priorities. Statistics show that approximately €10 trillion in citizens’ savings are held in bank deposits. While these deposits offer security and easy access, they provide lower returns compared to capital market investments. Investments create opportunities for more efficient use of this capital and deliver better returns for citizens. The direct participation of savers in capital markets will bring benefits not only to them individually but also to the economic development of the European Union.

European Commission, CMU High-Level Forum Final Report, European Central Bank Data (2023–2024 estimates)

According to Eurostat data for 2024, the financial assets of households in the EU are distributed as follows:

| Shares and Investment Fund Units: 35.9% |

| Currency and Deposits: 31.2% |

| Insurance, Pensions and Standardized Guarantees: 26.9% |

| Other Financial Assets: 6.0% |

Households – statistics on financial assets and liabilities

Citizens’ savings should not be viewed solely as a form of individual financial security, but also as a strategic resource that can support capital markets and facilitate the transition to an innovative, green, and socially sustainable economy.

Against the backdrop of record-high inflation in 2022 and 2023, combined with the relatively low returns from traditional savings instruments such as deposit accounts and government bonds, EU citizens are facing the need to seek alternative strategies for preserving and growing their personal capital. According to data from the European Central Bank (ECB), the real return on household savings was negative for six consecutive quarters during 2022 and 2023, posing a significant challenge for low- and middle-income households. Studies by the OECD indicate that over 60% of EU citizens feel uncertain when making investment decisions and managing risk, highlighting the need for educational efforts at both supranational and national levels.

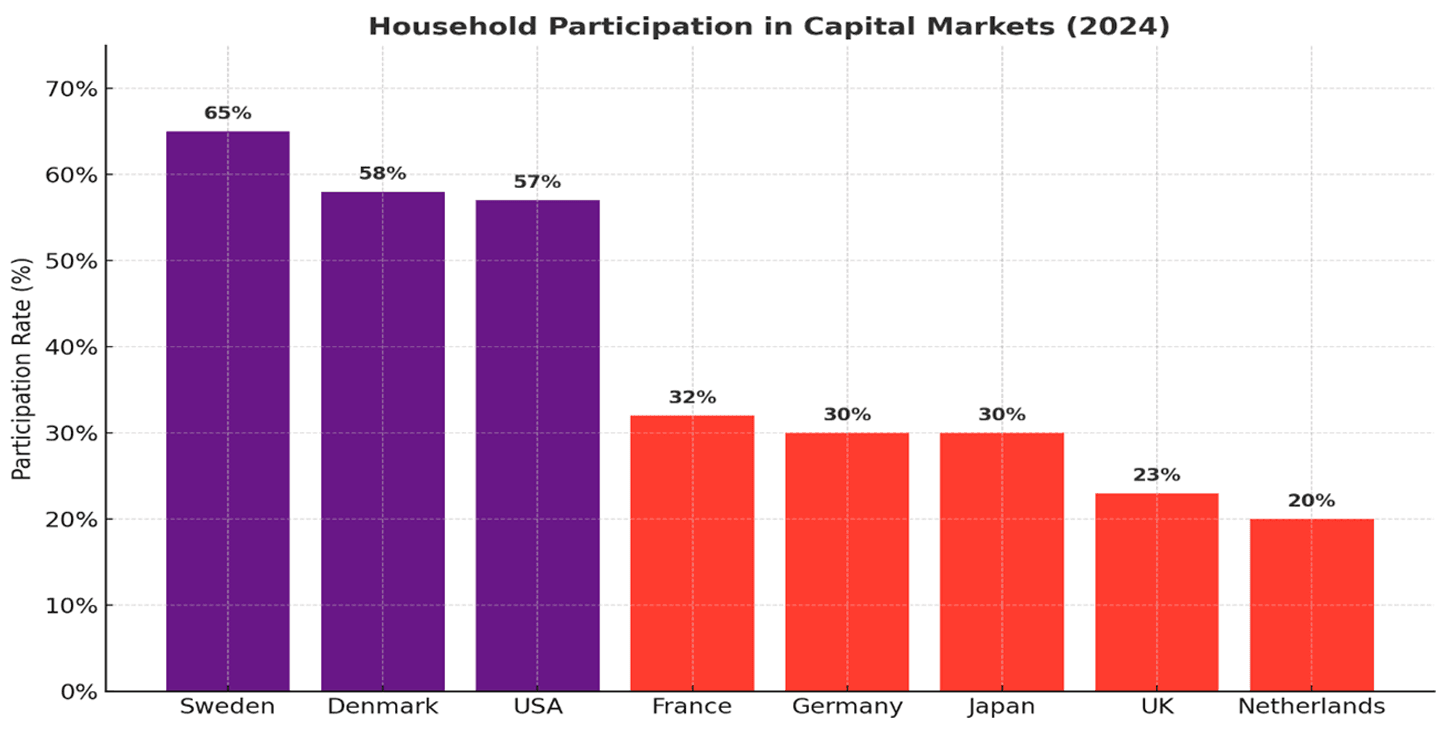

Despite accumulated savings and a relatively stable economic environment in most Member States, European citizens remain cautious about investing in capital market instruments. This hesitancy places the EU at a disadvantage compared to other advanced economies such as the United States and Japan, where retail investor participation is significantly higher. A closer look at the statistics reveals deep structural differences. In the United States, approximately 43% of household financial assets are held in stocks, bonds, and other market-based instruments, while in Japan this share is nearly 30%. In contrast, in the EU, the figure barely exceeds 17%, raising concerns about the Union’s ability to mobilize internal sources of financing for economic growth, innovation, and the green transition.

An updated table reflecting the structure of household financial assets in selected EU Member States as of the third quarter of 2024 is presented below. The data are collected from official sources, including the European Central Bank (ECB), Eurostat, and national statistical institutes.

Structure of Household Financial Assets by Country (Q3 2024)

| Country | Deposits (%) | Insurance & Pensions (%) | Investment Funds (%) | Shares & Other Equity (%) |

| Germany | 36.5 | 32.0 | 18.0 | 13.5 |

| France | 34.0 | 36.0 | 12.0 | 18.0 |

| Italy | 48.0 | 26.0 | 12.0 | 14.0 |

| Netherlands | 28.0 | 46.0 | 16.0 | 10.0 |

| Spain | 42.0 | 32.0 | 11.0 | 15.0 |

| Sweden | 22.0 | 42.0 | 21.0 | 15.0 |

| Poland | 58.0 | 22.0 | 10.0 | 10.0 |

| Bulgaria | 68.0 | 16.0 | 6.0 | 10.0 |

Beneath the surface of these data lie complex socio-psychological and cultural factors. Many Europeans approach financial markets with skepticism, often perceiving them as complex, unpredictable, and associated with high risks. The lack of sufficient financial literacy, combined with a negative media portrayal of speculative investments, contributes to the formation of a strong culture of caution. Unlike the American investment culture, which is built around long-term participation in the stock market through pension funds and individual investments, Europe is dominated by saving models focused on bank deposits, insurance products, and real estate.

The historical context should not be overlooked either—economic and banking crises in certain countries, weak investor protection in the past, and limited access to transparent investment products have fostered a lasting mistrust. In addition, a significant portion of European households exhibit a low risk tolerance, which leads to limited demand for more volatile, though potentially higher-yielding, assets.

Against this broader investment landscape, the European Commission is making a bold call for EU households to rethink the role of their savings and redirect them from traditional bank deposits to more dynamic and productive capital markets. At the core of the “Savings and Investment Union” strategy lies a set of targeted tax incentives designed to transform the way investors approach financial planning. Particular emphasis is placed on introducing reduced tax rates on capital gains and dividends, with these preferences aimed not only at encouraging investment, but also at promoting more long-term, sustainable investment practices.

The measures include tax relief for investments in green bonds, innovation funds, and start-ups in priority sectors such as renewable energy and the digital economy. In this way, the European Commission establishes a direct link between citizens’ personal financial well-being and the sustainable economic development of the region. Moreover, by introducing tax breaks for pension-oriented investment products, the initiative aims to address the long-term challenges associated with demographic change and an aging population, offering citizens additional incentives to plan their financial future through capital markets.

Turning to regulation and oversight, the strategy emphasizes the creation of a stronger and more centralized supervisory structure aimed at unifying and optimizing the currently fragmented oversight mechanisms across the EU. This innovation is a response to the growing complexity and dynamism of financial markets, particularly in relation to new asset classes such as cryptocurrencies and decentralized finance platforms (DeFi). The European Commission plans to assume direct supervision over key trading infrastructures and platforms, ensuring a higher degree of transparency and stability. The European Securities and Markets Authority (ESMA) has been granted extended powers for direct supervision of key trading platforms, including innovative decentralized fintech solutions. Through tighter controls over cryptocurrencies and DeFi platforms, the EU ensures that investments are protected from manipulation and systemic risks, thereby boosting confidence among both retail and institutional investors. The effect will be twofold: on one hand, investor trust—essential to market development—will increase; on the other, a foundation will be created for innovation within a secure regulatory environment, allowing experimentation with new financial products and technologies to evolve under controlled and predictable conditions.

The third key pillar of the strategy directly addresses the banking sector through a revision of regulations related to securitization—the process by which banks convert loans and other financial assets into tradable securities. The European Commission proposes adapting and simplifying the rules to facilitate this mechanism and free up capital on banks’ balance sheets. This would allow banks to issue more loans, encouraging the private sector and households to invest in the economy. Regulatory flexibility is especially important in light of low interest rates and slow economic growth in some EU regions, which limit investment potential. Through securitization, financing for new projects—from infrastructure to technological innovations—will become more accessible and efficient. In Italy and Spain, banks have already shown increased activity following this model, enabling small and medium-sized enterprises to access the capital needed for digitalization and green modernization.

In parallel, there is growing interest in sustainable investing—so-called ESG (Environmental, Social, and Governance) investments. For many Europeans, especially younger generations, the ability to direct their capital toward projects with a positive impact on society and the environment serves as a strong motivational factor. At the heart of this shift lies the aspiration to build an economy that balances financial returns with social and environmental responsibility. This trend is clearly reflected in the statistics: in 2023, investments by major European companies in sustainable projects exceeded €250 billion, representing a 34% increase compared to the previous year. These funds are actively supporting projects in areas such as renewable energy, green transport, and the circular economy.

The European Commission is supporting this growth through innovative tax mechanisms. Several Member States have introduced reduced tax rates on income derived from investments in green bonds, significantly increasing their attractiveness. In Germany and France, these incentives are already being applied successfully, while the Netherlands is introducing additional tax credits for investors in socially responsible funds.

Beyond financial and regulatory instruments, digitalization is a powerful catalyst for rethinking investment models. The development of intuitive online platforms, mobile applications, and robo-advisory services offers a new paradigm in which investing is no longer the exclusive domain of seasoned players or high-net-worth individuals. Technology is democratizing access, reducing transaction costs, and enabling easier portfolio management, even with low initial amounts. AI-powered robo-advisors provide simple and personalized access to capital markets, allowing even retail investors to build portfolios that reflect their values and investment goals.

This is where the future potential lies. If the barriers of distrust, information gaps, and cultural caution can be overcome, European citizens could become key participants in the transition toward a greener and more innovative economy. This comprehensive and harmonized EU strategy—from tax incentives and centralized regulation to digital technologies—shapes a new investment paradigm. It transforms the ordinary citizen into an active player in the financial markets, whose savings not only generate returns but also contribute to environmental protection and the sustainable development of society. This tangible reality, backed by growing flows of green capital, is becoming a driving force of the European economy and a global model to emulate.

European Central Bank Household Finance and Consumption Survey (HFCS)

The European Commission recognizes that the key to the sustainable development of financial markets and the successful inclusion of citizens in investment opportunities lies in comprehensive financial education and transparency. According to the Organisation for Economic Co-operation and Development (OECD), financial literacy encompasses three core components: financial knowledge, financial behavior, and financial attitudes. These elements are measured through standardized questionnaires that assess the understanding of basic financial concepts—such as interest, inflation, and risk—as well as the ability to apply this knowledge in real-life situations.

In 2023, the OECD published its most recent international survey on adult financial literacy across 39 countries, including 20 OECD members. The study revealed that the average combined score (knowledge + behavior + attitudes) was 12.7 out of a maximum of 21 points. High scores were observed in countries such as the Czech Republic, Hong Kong (China), and Estonia, while developing economies or countries with lower levels of institutional support—such as Argentina and Indonesia—ranked significantly lower. (OECD/INFE, 2023)

In parallel, a survey by the European Commission (Eurobarometer, 2023) found that only 18% of EU citizens possess a high level of financial literacy. The differences between countries are considerable: in the Netherlands, Sweden, and Denmark, over 25% of respondents demonstrate strong financial education, whereas in Romania, Bulgaria, and Portugal, less than 10% show the necessary knowledge and skills. At the same time, 64% of Europeans fall into the intermediate category, indicating significant potential for improvement through targeted educational policies. (European Commission, 2023)

These empirical observations find further explanation through the concepts of behavioral economics. Very often, savers are not guided by rational analysis but by cognitive biases such as the “present bias” (a preference for immediate rewards over future gains), overconfidence, loss aversion, and others. Such factors lead to lower savings rates, excessive indebtedness, and weak participation in long-term financial instruments. Financial behavior is frequently the result of habits formed during childhood, as well as the social environment in which a person lives—including cultural attitudes toward money, intergenerational transfers of knowledge, and societal trust in financial institutions.

In this regard, a series of innovative measures are being introduced in 2025 to standardize and improve the level of financial literacy among the EU population. These include the development of unified tools for assessing personal finance management skills, which will allow institutions to identify knowledge gaps among citizens and direct appropriate educational initiatives. This standardization will help both public authorities and private financial institutions to create targeted and effective training programs. For example, in Estonia, digital financial education platforms are already operational and integrated into the national curriculum, reaching a wide range of age groups—proving the success of the EU model for digitalization and education.

At the same time, the European Commission is advocating for the introduction of mandatory financial education programs to be integrated both into school curricula and adult continuing education. These programs are designed not just to provide passive knowledge, but to build practical skills in budgeting, risk management, and making informed investment decisions. Special attention is given to preparing citizens to manage pension funds and other long-term savings products, which directly addresses demographic challenges and the need for financial security in retirement. In Germany, in recent years, specialized financial education courses have been developed, including practical seminars and digital simulations aimed at increasing investor engagement and competencies.

An important part of this initiative is also the enhancement of financial product transparency through clearer and simplified informational documents, such as PRIIPs – Packaged Retail and Insurance-based Investment Products. These documents are designed to translate complex financial terminology and risk parameters into a comprehensible language that any investor, regardless of experience level, can understand. This means greater clarity regarding fees, risks, and potential returns of products, which will help reduce the information asymmetry between financial intermediaries and clients. The new transparency standards are supported by digital platforms and interactive tools that facilitate comparison between different investment products and assist in making more informed choices. In France, such initiatives have already been implemented through public campaigns and online portals, which allow consumers to compare the terms of various insurance and investment products in real time.

European societies are increasingly confronted with the challenges of an aging population—a trend that is significantly transforming the structure of the economy, social policy, and financial stability. According to the latest Eurostat data from 2024, the share of the population over the age of 65 in the European Union has reached a record 22.4%, and projections for the next 30 years suggest that this figure will exceed 30% in several Member States. This demographic trend is placing increasing pressure on public pension systems, which are facing growing financial strain.

In addition to macroeconomic risks, the demographic structure of the EU is also intensifying pressure on pension systems and creating the need for private forms of long-term security. To meet the growing investment needs, the EU will require an additional €750 to €800 billion annually until 2030, with this need expected to increase, especially due to rising defense expenditures. The Savings and Investment Union (SIU) aims to close the gap between savings and investment needs by improving the efficiency and scale of investments in both banking and capital markets, including through the participation of institutional investors. This will provide companies with access to significant capital within the EU, which is particularly important for many technology firms that still face difficulties in securing the necessary funding from the Union’s markets.

It is gaining exceptional importance as a key factor for ensuring long-term sustainability and an adequate standard of living after retirement. Traditional state pensions are increasingly proving insufficient to meet the actual needs of the elderly, due to their limited amounts and the longer life expectancy. An analysis by Eurostat (2024) shows that the average expected pension in the EU covers only about 60–70% of the necessary expenses for maintaining a normal standard of living after retirement. In some countries, this proportion is even lower—for example, in Bulgaria and Greece, the expected pension covers only around 50% of the required needs. This creates a significant gap and increases retirees’ dependence on social assistance and other forms of state support.

Expected Public Pension vs. Real Living Standard Needs in Selected EU Member States (Eurostat, 2024)

| Country | Expected Pension (% of Required Income) | Population Aged 65+ (2024) |

| Germany | 68% | 22.0% |

| Poland | 65% | 18.9% |

| Netherlands | 75% | 21.5% |

| Austria | 70% | 22.8% |

| Bulgaria | 50% | 22.1% |

| Spain | 62% | 23.7% |

In this context, the main innovation in the EU’s pension policy for 2025 is the introduction of a range of tax incentives and regulatory facilitations aimed at making pension products more attractive and accessible to a broader range of investors. These include lower income tax rates on contributions to voluntary pension funds, tax exemptions on investment returns, and inheritance tax relief—providing additional security and flexibility in managing retirement savings. These measures are accompanied by guarantees for transparency and investor protection, ensuring clarity regarding fees, risks, and expected returns on products.

The European Commission is also working to harmonize the regulatory framework for individual pension products in order to facilitate cross-border provision and access to a wider range of financial instruments. This will allow citizens to choose pension schemes that best fit their personal and professional circumstances without being limited by national borders. Such an approach encourages competition among pension providers and stimulates innovation, including the integration of sustainable investment opportunities aligned with the goals of the European Green Deal. One of the key tools for encouraging participation in pension funds is the use of tax incentives, which are applied in various countries to motivate citizens to build up their own personal retirement reserves. The examples of Poland, the Netherlands, and Austria illustrate how policy can positively influence individual saving behavior.

In Poland, tax relief on pension fund contributions, along with state co-payments, actively encourages younger generations to invest in long-term pension plans. The system also includes elements of automatic enrolment, which increases participation in private pension products. In the Netherlands, supplementary pension funds benefit from significant tax advantages as part of a comprehensive three-pillar pension system—one of the most sustainable in Europe. Austria also applies a combination of tax incentives and employer-targeted preferences to support employees in joining additional pension plans.

The introduction of digital platforms and tools for managing pension savings offers investors greater control and insight into the status of their assets. Powered by artificial intelligence and machine learning, these systems provide personalized investment strategies tailored to individual risk profiles and time horizons, significantly enhancing the effectiveness and appeal of voluntary pension solutions.

In addition to financial and technological innovations, the EU’s strategy places special emphasis on educational initiatives related to retirement planning. By integrating pension awareness into the broader framework of financial education, citizens are encouraged to take a more active role in building their financial security for later life. This includes informational campaigns, seminars, and digital trainings that explain the importance of early and systematic saving, as well as how to choose optimal pension products.

The European Union is not merely defining new financial frameworks and policies—it is outlining a path toward a future in which economic security and sustainability become inseparable aspects of every citizen’s life. By embedding innovation, transparency, and education at the core of capital markets, the EU is reshaping traditional models of investing and retirement planning, empowering individuals to take control of their financial futures. It is a vision that meets the challenges of the present and fosters a sustainable and fair economy, where every investor—regardless of the size of their portfolio—can become an active participant in the green transition, the digital revolution, and social well-being.

In this sense, the strategies of the European Commission are more than policy—they represent a profound transformation that will shape the lives and prosperity of future generations, leaving behind a legacy of opportunity, fairness, and progress.

The time for change is now.This transition is not easy, but it is possible. It requires a willingness to learn, the courage to face the unknown, and the readiness to seize the new opportunities offered by digitalization, innovation, and sustainable financial instruments. Every investment made with the future in mind is a step toward a more secure life and a more resilient economy.

Official ECB statistics on household savings and investment trends.

ECB survey on household assets, liabilities, income, and consumption behavior.

EU-wide survey measuring public opinion, including financial literacy.

Official EU report summarizing Capital Markets Union strategies and recommendations.

EU statistical office providing official statistics on demographics, pensions, and financial markets.

Data on structure and trends of household financial assets across the EU.