Introduction

The Regulation (EU) 2023/1114 of the European Parliament and of the Council on Markets in Crypto-Assets (MiCA) has applied since 30 December 2024. Its application marks a turning point in the legal framework governing digital assets within the European Union. By establishing uniform rules for the issuance, offering to the public and admission to trading of crypto-assets, as well as for the provision of crypto-asset services, MiCA seeks to enhance legal certainty, ensure investor protection, safeguard market integrity and foster innovation under a clear regulatory environment. The application of MiCA also confirms the EU’s ambition to serve as a global standard-setter in digital asset regulation, providing a comprehensive model that other jurisdictions may look to when shaping their own regulatory frameworks.

MiCA is not just another EU Regulation. It represents a strategic shift in the evolution of crypto markets – an attempt to reconcile the freedom of innovation with the reliability of financial stability. Prior to MiCA, EU member states relied on fragmented national regimes that differed significantly in scope and intensity. France developed its own licensing framework for digital asset service providers, Germany applied a more flexible approach in qualifying assets, while Malta and Cyprus introduced extensive national rules to position themselves as crypto-friendly jurisdictions. In other member states, particularly in parts of Eastern Europe, regulatory approaches remained less defined, often limited to the transposition of anti-money laundering directives (AMLD IV and subsequent updates).

For investors, this patchwork resulted in regulatory uncertainty and limited cross-border consistency. For startups, it created barriers to scaling across the EU single market. For regulators, it posed coordination challenges and risks of regulatory arbitrage. The absence of a harmonised EU framework did not mean the absence of rules, but rather the existence of divergent national regimes. MiCA therefore fills a critical gap by establishing uniform standards across the Union, enhancing legal certainty, protecting investors, and ensuring a level playing field for market participants.

MiCA aims to put an end to this fragmented approach. It introduces clear rules for all participants – token issuers, exchanges, custody providers, wallet operators, and even influencers who promote crypto projects. And most importantly, it does so through a single passporting regime: obtaining a license in one country grants access to the entire internal EU market.

According to the European Commission, MiCA has three main objectives:

How will this be achieved in practice? Through the regulation of specific categories of tokens and the introduction of a licensing regime for all crypto-asset service providers (CASPs). But also through a global impact: even companies outside the EU that want to offer crypto services within the Union will have to comply with MiCA.

The end of this “freedom” does not mean the end of innovation. On the contrary – it is precisely through the introduction of trust, resilience, and transparency that the next stage of the sector’s development can be defined. For the first time since the creation of Bitcoin, the crypto world is entering into a genuine dialogue with the law. And, as always in such moments, survival will not belong to the loudest voices, but to those who adapt the fastest.

What is MiCA: Key Concepts and Scope

In a world where new tokens are born daily and markets operate 24/7 across borders and jurisdictions, MiCA aims to do something ambitious: to introduce a common framework for all crypto-assets that have so far existed in the legal grey zone. MiCA doesn’t just define a few terms—it lays out a full architecture for a new financial world. At first glance, the regulation might seem technical, but behind the legal language lies a crucial element: clearly defined categories of assets and activities that are, for the first time, officially recognized at the EU level.

MiCA regulates three main categories of tokens, each carrying a different level of market and consumer risk:

But regulation does not stop at the assets themselves. MiCA has a horizontal scope that covers the entire ecosystem.

This is one of the most revolutionary aspects of MiCA. Under this definition fall crypto exchanges, trading platforms, custodians, hosted wallet providers, and other market intermediaries. All of them are required to obtain a license and comply with rules on corporate governance, capital adequacy, conduct of business, and cybersecurity.

Even more interesting is MiCA’s extraterritorial effect: if a company from the United States, Singapore, or Switzerland wants to offer services or tokens to European users, it must also comply with the Regulation’s requirements, unless the case falls under the “reverse solicitation” exemption. This turns MiCA into a tool with the potential for global impact.

| Regulation | Connection with MiCA |

| MiFID II | MiCA does not apply to crypto-assets that qualify as financial instruments under MiFID II (Art. 2(4)(a) MiCA). The two regimes are distinct but co-exist within the EU Digital Finance framework. MiFID II continues to govern financial instruments, while MiCA covers crypto-assets that fall outside MiFID II. |

| DORA | Part of the EU Digital Finance package alongside MiCA and the DLT Pilot Regime. DORA establishes rules on cybersecurity and operational resilience which apply to CASPs as well, ensuring consistency with MiCA obligations. |

| AMLD6 | Anti-money laundering obligations remain primarily under AMLD6, but MiCA introduces complementary transparency and governance requirements that must be aligned with AMLD frameworks. |

| GDPR | Personal data protection rules under GDPR continue to apply fully to crypto-asset activities. MiCA does not override GDPR but operates in parallel, particularly regarding CASP record-keeping and reporting obligations. |

Table 1 MiCA and the Existing Regulatory Framework

In other words, MiCA is a central element of the EU’s Digital Finance package — together with MiFID II, DORA and the DLT Pilot Regime. To be effective, it must be implemented in harmony with these other regulatory frameworks. For market participants, this means not just compliance, but strategic adaptation to an integrated and evolving digital finance ecosystem.

Market Impact

MiCA introduces a multilayered architecture of rights and obligations for key participants in the crypto market, marking a full-scale transformation of the ecosystem.

For issuers:

The requirements differ depending on the category of tokens. Issuers of tokens under Title II must prepare a white paper describing the nature, functions, risks, and associated rights of the crypto-asset, and notify the competent authority (Arts. 6–21 MiCA). For ARTs, the white paper is subject to approval as part of the licensing process. EMTs, which can only be issued by credit institutions or electronic money institutions, are subject to prudential and reserve requirements. Thus, the obligations are not identical for “every issuer.”

For crypto-asset service providers (CASPs), such as exchanges, brokers, custodians, and wallet providers, MiCA establishes a licensing regime based on clear and stringent conditions. These include:

CASPs will also be held responsible for preventing market manipulation, fraud, and insider dealing. They must adhere to principles of sound governance and professional conduct, reflecting standards from the traditional financial sector.

For stablecoin operators (ART and EMT):

The framework introduces measures designed to limit risks to financial stability. In addition to registration, authorization is required in many cases. Issuers that reach a significant market share or cross-border relevance fall under enhanced supervision by the European Banking Authority (EBA). Additional restrictions may apply to ARTs, while EMTs denominated in a currency other than the official currency of an EU Member State may be subject to caps on their use in payments if such use is deemed to undermine the effectiveness of official currencies.

Environmental considerations are also explicitly addressed. MiCA mandates public disclosure of the energy impact of consensus mechanisms (such as proof-of-work), aiming to reduce the carbon footprint and align with the EU’s sustainable finance agenda.

Last but not least, the environmental dimension of the crypto sector is not overlooked. MiCA mandates public disclosure of the energy impact of consensus mechanisms used (such as proof-of-work), with the aim of reducing carbon footprints and aligning with the EU’s ESG standards.

As a result, MiCA acts both as a tool for legal clarity and as a catalyst for professionalization, ethical conduct, and sustainability in crypto finance.

Licensing and Supervision: What Lies Ahead for Businesses

After a decade of “innovation before regulation,” crypto businesses in the EU are entering a new reality — one defined by a licensing regime. MiCA not only outlines what falls under regulation, but also clearly defines who exercises supervision, how licenses are issued, and what compliance obligations exist. This transformation will fundamentally reshape the operational logic of the sector — from emerging startups to established platforms.

Supervisory Architecture: Who Is Responsible for What

MiCA establishes a multi-layered supervisory framework, where National Competent Authorities (NCAs) in each Member State hold the primary responsibility for licensing, monitoring, and day-to-day oversight. Any company wishing to provide crypto-asset services in the EU must register and submit its application to the NCA of the Member State in which it is established.

At the supranational level, two institutions assume coordination and supervisory tasks:

The aim of this two-tier system is harmonization: to guarantee that MiCA’s requirements are applied consistently across all Member States, safeguarding financial stability and strengthening trust in the EU single market.

Passporting Regime: One License, Many Opportunities

One of MiCA’s most significant innovations is the introduction of the so-called “passport” for crypto-asset services. Once a provider obtains authorization from its National Competent Authority (NCA), this license allows it to offer services across all EU Member States without the need for additional approvals.

This framework removes barriers to cross-border operations, fosters legal certainty, and creates the conditions for faster and more scalable growth of crypto-asset businesses across the Union.

What Lies Ahead for Existing Companies

For entities already providing crypto services in the EU at the time of MiCA’s application, a transitional regime applies. Its length varies depending on the jurisdiction, but in all cases it will end no later than July 2026. During this period, companies must bring their activities into full compliance with MiCA and obtain the necessary license from their National Competent Authority (NCA).

Until then, providers may continue operating, but only in line with applicable national legal frameworks. Where no prior supervisory framework existed, companies must prepare to comply with MiCA requirements in accordance with Article 148.

The transitional period is not merely a formality — it is a stress test. Companies will be required to:

At the end of the transitional period, entities that have not secured the required license will no longer be permitted to operate.

How to Prepare: Four Practical Steps

White Paper: From Marketing Promise to Legal Responsibility

Every issuer will be required to publish a White Paper – a document that not only describes the economic and technical parameters of the token but also provides a comprehensive disclosure of the associated risks, rights, and obligations. For the first time in EU history, such a document is subject to strict regulatory oversight.

Misleading or incomplete information contained in a White Paper may result in administrative fines, operational restrictions, and potential civil liability claims. This marks a decisive shift: what was once a marketing tool is now a legally binding instrument of investor protection and market integrity.

Consumer Protection: From Slogan to Practice

MiCA transforms the user from a passive early adopter into an active investor with enforceable rights. CASPs will be required to:

Misleading information may result not only in fines or operational restrictions, but also in civil liability claims.

Third-Country Activity: No Longer a Grey Zone

Companies established outside the EU that wish to provide crypto-asset services to EU clients must comply with MiCA. Without a license, there is no access to the European market. This extraterritorial effect gives MiCA global reach and establishes a new level of legal certainty and consumer protection.

However, the “reverse solicitation” exemption under Article 61 MiCA should be noted, even if interpreted narrowly. It allows EU clients to approach third-country providers on their own exclusive initiative, without this being deemed as the provider offering services within the EU.

Transitional Regimes and Derogations: Temporary Flexibility

MiCA foresees temporary derogations, enabling certain operators to continue activities for a limited period without immediate authorization. This grace period is conditional and strictly supervised. Regulators will closely monitor for misuse or delays, and failure to comply with timelines will result in termination of activities.

Sanctions and Enforcement: Protection Through Stringency

MiCA introduces a clear and strict sanction mechanism: from administrative fines and restrictions to license revocation. The European Commission and ESMA emphasize that penalties must be “effective, proportionate, and dissuasive.” This means supervision will be active, thorough, and with zero tolerance for non-compliance.

MiCA does not merely regulate the sector. It raises the bar — and gives a chance only to those ready to play by the new rules. For the rest, the EU market will remain closed.

Key Dates and Implementation Timeline of MiCA

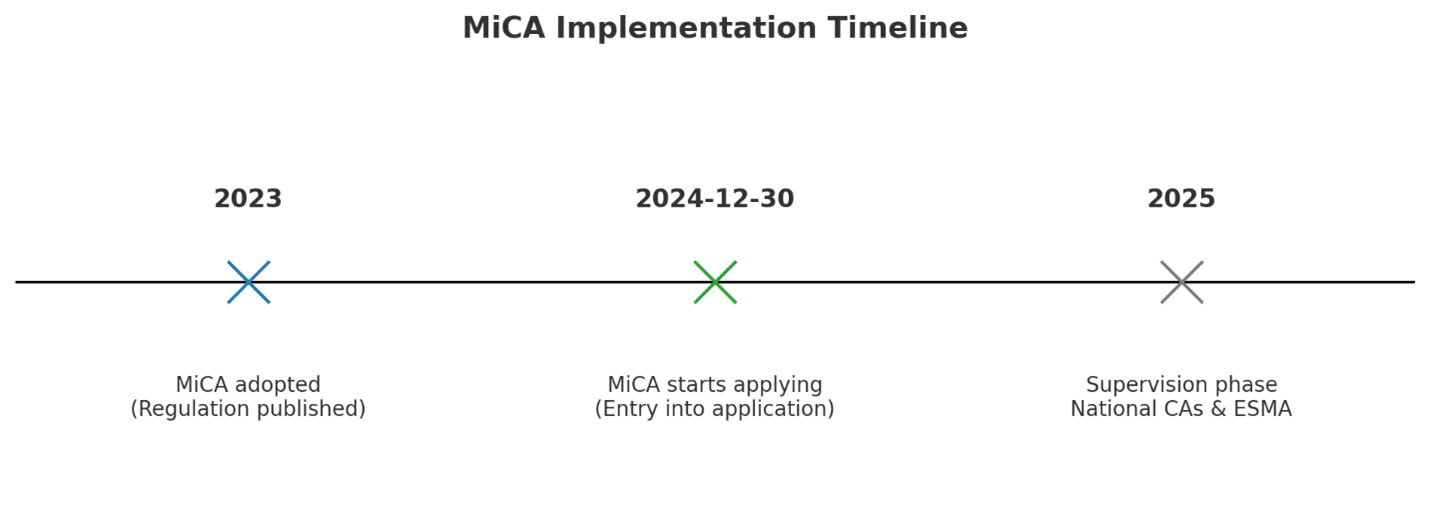

Picture 1 Regulatory Timeline of MiCA

| Date | Event | Description |

| 29 June 2023 | Publication in the Official Journal of the EU | Marks the official start of MiCA’s existence. Starting point for phased implementation. |

| 30 June 2024 | Application to EMT and ART (Stablecoins) | Issuers must receive approval, maintain reserves, and comply with EBA supervision. |

| 30 December 2024 | Application to all CASPs | CASPs must obtain a license and begin complying with MiCA requirements. |

| By 1 July 2026 | End of transitional regime | Member States may allow existing firms to operate temporarily while working toward compliance. |

Table 2 MiCA Implementation Timeline: Key Dates and Obligations

Opportunities and Challenges: The New Crypto Reality

MiCA is now a reality. What once sounded like a regulatory utopia — a unified framework for crypto-assets across the European Union — is becoming an operational fact, complete with concrete timelines, licensing regimes, and clearly defined responsibilities. But the adoption of the regulation is not the end of the story. On the contrary — it’s just the beginning.

For consumers, this means peace of mind. Not just because platforms will now be under regulatory oversight, but because transparency, clarity of terms, and protection of funds are no longer optional — they are legally guaranteed. For the first time in the EU, crypto is beginning to resemble a space with real consumer rights, institutional standards, and predictability.

From a business perspective — especially for companies with European roots — the new regulation is a long-awaited recognition. Until now, innovation evolved on the edge of a legal gray zone. Now, it’s being given a stage — as long as it’s ready to operate within clear, albeit demanding, rules. The single “passport regime” opens the door to over 450 million potential users without the need for multiple national registrations. A startup from Sofia can legally and efficiently operate in Vienna, Paris, or Riga. This is no longer an abstraction — it’s the new normal.

From a business perspective — especially for companies with European roots — the new regulation is a long-awaited recognition. Until now, innovation evolved on the edge of a legal gray zone. Now, it’s being given a stage — as long as it’s ready to operate within clear, albeit demanding, rules. The single “passport regime” opens the door to over 450 million potential users without the need for multiple national registrations. A startup from Sofia can legally and efficiently operate in Vienna, Paris, or Riga. This is no longer an abstraction — it’s the new normal.

However, this new normal comes with the price of maturity. MiCA is a stress test for the entire sector’s resilience. Licensing, capital requirements, AML/KYC policies, ESG disclosures, and continuous supervision are not just administrative details — they demand resources, dedicated teams, and strategic rethinking. Smaller players, accustomed to anonymity and agility, will face serious barriers to entry. And for those relying on “network untraceability,” a difficult transition begins.

Despite its ambitious scope, MiCA does not comprehensively regulate all elements of the crypto ecosystem. Two of the fastest-growing areas — non-fungible tokens (NFTs) and decentralized finance protocols (DeFi) — remain outside the full regulatory reach of the current framework.

While some NFT projects may fall under MiCA (for example, if they are widely used for investment purposes), most are excluded from licensing and disclosure obligations. This creates a degree of legal uncertainty for platforms that trade or offer NFTs, especially when their use closely resembles that of financial instruments.

DeFi protocols present an even greater regulatory challenge. By nature, they are often fully decentralized, with no central entity that could be licensed or sanctioned. This raises questions about the applicability of standard licensing mechanisms and creates the risk of a regulatory vacuum.

Nevertheless, European institutions are already considering an extension of the framework — the so-called MiCA II — which is expected to include guidance on NFTs, DeFi, and potentially even the tokenization of real-world assets.

In the short term, this lack of clarity may discourage some innovative models or push them toward more lightly regulated jurisdictions. But in the long term, it opens the door to building a flexible and technologically compatible regulatory approach that takes into account the specificities of emerging paradigms.

The key will be balance: between legal certainty and innovation freedom.

Picture 2 Key Impacts on the Crypto Sector

Let’s not underestimate the opportunities either.MiCA is already attracting the attention of institutional investors, banks, pension funds, and growth funds that had previously stayed away. Security, predictability, and unified rules are transforming trust into a new currency — one that unlocks capital flows.

The sector is already beginning to reorganize. We’re seeing licenses issued, warnings published, and the first attempts at coordination between platforms and regulators. And more will likely follow — including the first sanctions, suspended operations, and market exits. A new kind of race will begin: not so much between code and ideas, but between legal teams, compliance experts, and cross-border positioning strategies.

MiCA doesn’t give all the answers, but it puts all the right questions on the table.

A “MiCA II” is likely to follow, expanding the horizon toward Web3, tokenization of real-world assets, and the new paradigms of the digital economy. But even now, the message is clear: innovation is welcome — as long as it is responsible. Expecting all crypto platforms to adapt smoothly might not reflect the reality of the sector.

Practical Effects of MiCA Implementation: Reality Kicks In

MiCA in Action: First Market Signals and Global Response

Since 30 December 2024, the MiCA Regulation has been in full application across the EU. Its impact is already tangible: compliance preparations, restructuring of certain activities, suspension of non-compliant operations, and strategic adjustments are actively taking place across Europe. Regulatory reality is no longer a matter of anticipation — it requires present-day action.

National regulators have responded with varying speed but equal determination. In France, the AMF has begun re-registering service providers and is requesting additional documentation from all those transitioning to full MiCA licenses. In Germany, BaFin is applying its existing framework as a base but has tightened requirements for reporting and capital adequacy. Lithuania — known for its concentration of crypto companies licensed as electronic money institutions — has emphasised that “registration is not a license” and launched a campaign to identify falsely regulated platforms. Cyprus has taken a more consultative approach, engaging with industry stakeholders to facilitate a smoother transition.

Supervision is no longer just on paper.

Since 30 December 2024, MiCA has been fully applicable across the European Union. Supervision of issuers of significant ARTs and EMTs has intensified, with the European Banking Authority (EBA) exercising its designated powers under Title III of MiCA, including stress testing, information requests, and prudential requirements. In parallel, the European Securities and Markets Authority (ESMA) has begun monitoring compliance of CASPs with licensing obligations and coordinating practices among National Competent Authorities (NCAs). This shows that MiCA supervision is no longer a matter of formal rule-making but a concrete reality enforced across Member States.

Major players are also making moves

Several global exchanges and service providers have restructured their EU operations in response to MiCA. Binance has scaled down or withdrawn from certain jurisdictions such as the Netherlands, while Kraken has consolidated operations into licensed EU hubs. Revolut has undertaken adjustments to its crypto division in order to comply with disclosure, reserve, and governance obligations. These examples illustrate that the regulatory shift is reshaping not only compliance frameworks but also business strategies.

Against this backdrop, smaller fintech firms and startups face a strategic choice: consolidate, seek partnerships, or exit crypto markets altogether if unable to meet the new requirements. Meanwhile, institutional investors — long cautious about entering the sector — are beginning to participate more actively, perceiving MiCA as a framework that brings credibility, stability, and investor protection.

At the same time, some retreat is evident

Tokenization projects, NFT platforms, and certain DeFi providers have delayed or cancelled their EU launches due to legal uncertainty and the costs of compliance. The interpretation of MiCA, particularly in borderline cases involving overlap with MiFID II or GDPR, will crystallize through supervisory practice and case law in the coming years. These early precedents will shape the long-term standards and market reality across Europe.

| Regulatory Element | EU (MiCA) | USA (SEC/CFTC) |

| Legal Status | Unified | Fragmented |

| Supervision | Coordinated (EBA + NCAs) | Fragmented (SEC, CFTC, individual states) |

| Definitions | Explicit and harmonized | Lacking or disputed |

| Regulatory Approach | Preventive, rule-based | Enforcement-driven, sanction-based |

| Licensing | Single EU-wide passport | No centralized framework |

| NFT/DeFi | Outside scope, planned under MiCA II | Unregulated, low priority |

| Global Influence | Regulation with extraterritorial effect | Limited to domestic market |

| Timeline | Planned and phased | Often ad hoc and reactive |

Table 3 Comparative Overview: EU vs. US Crypto Regulation (MiCA vs. SEC/CFTC)

As GDPR became the global benchmark for personal data protection, MiCA is now shaping the framework that jurisdictions outside the EU are beginning to reference. Switzerland, the United Kingdom, and Singapore are adjusting their regulatory approaches to align with this new standard. For globally minded companies, MiCA compliance is emerging as a competitive advantage. With clear definitions, a structured supervisory architecture, and a unified “passport” for crypto services, Europe is not merely regulating — it is setting the regulatory norm.

In a landscape of fragmented regimes and mounting risks, that norm becomes a benchmark for trust and stability.

The era of “code is law” is over.

Now, the law reads the code — and expects it to comply.

MiCA is only the beginning. The real question is: who will write the next line?

Overview of the EU digital finance strategy, including MiCA, DORA, and the DLT Pilot Regime.

EU body supervising significant ART and EMT issuers under MiCA.

EU supervisory authority issuing technical standards and guidelines for CASPs under MiCA.

Official text of the MiCA Regulation published in the EU Official Journal.