“Investments in innovation, growth and quality jobs are not merely an economic goal – they are a reflection of our ambition for a sovereign, sustainable and competitive European Union.”

— Ursula von der Leyen, March 2025

President of the European Commission

In a world where global economic dynamics are being reshaped, technologies are evolving at an exponential pace, and challenges such as the climate crisis and geopolitical uncertainty are forcing countries into a state of constant adaptation, access to capital emerges as a fundamental resource—not only for economic development but also for strategic autonomy. It is in this context that the European Union realizes it can no longer afford to maintain a system in which tens of thousands of innovative companies, startups, and high-tech sectors are left without the necessary resources to unlock their full potential.

The problem is deeply structural: small and medium-sized enterprises (SMEs), which make up over 99% of all businesses in the EU and form the backbone of its economy, often rely almost entirely on bank financing. However, banking channels are limited, costly, and risk-averse—especially during periods of rising interest rates or economic uncertainty. As a result, the continent’s creative and entrepreneurial potential remains partially blocked—at a time when the world is betting on innovation, green technologies, and digital connectivity as key levers for prosperity.

At the same time, the EU holds enormous reserves of “idle capital”—more than €10 trillion concentrated in household bank deposits. These funds, while safe, yield low returns and fail to fuel the real economy. On one side are people with accumulated savings, worried about risk and often unaware of the opportunities offered by capital markets; on the other—industries of the future, in need of fresh capital but unable to access it. Between them lies a gap that EU institutions can no longer afford to ignore.

This is precisely why, in March 2025, the European Commission presented a new strategic framework aimed not merely at supporting economic financing but at transforming the very logic of capital access in the Union. These new measures are seamlessly embedded within the long-term vision of initiatives such as the Savings and Investment Union (SSI) and Capital Markets Union 2.0, which seek to build truly integrated and accessible financial markets.

This is a transformation not only in economic terms but also in cultural ones. It demands a new mindset, where investing is no longer a privilege reserved for institutional players but a tool for the economic participation of every citizen. The European Commission is betting on digitalization, tax incentives, platform-based innovation, and improved regulation to connect savers with entrepreneurs, ideas with resources, and needs with solutions.

At the core of this new model lies a firm message: access to capital is the key to European competitiveness, social cohesion, and strategic autonomy. If this access is not guaranteed for SMEs and critical sectors—the ones that will shape the future of the EU—then even the most ambitious policies will lack an economic backbone.

Today, more than ever, it is time to open the floodgates of financing. Not because it looks good on paper, but because it is the only way Europe can be competitive—not tomorrow, but right now.

One of the most serious structural challenges to the competitiveness and sustainable growth of the European Union is the chronic lack of effective access to capital for small and medium-sized enterprises (SMEs), as well as for key innovation sectors such as green energy, digital security, and semiconductor manufacturing. Although SMEs form the backbone of the European economy—generating over 50% of the EU’s GDP and providing jobs for approximately 100 million people—they continue to rely heavily on bank lending, which makes them particularly vulnerable in times of tight monetary policy and rising interest rates.

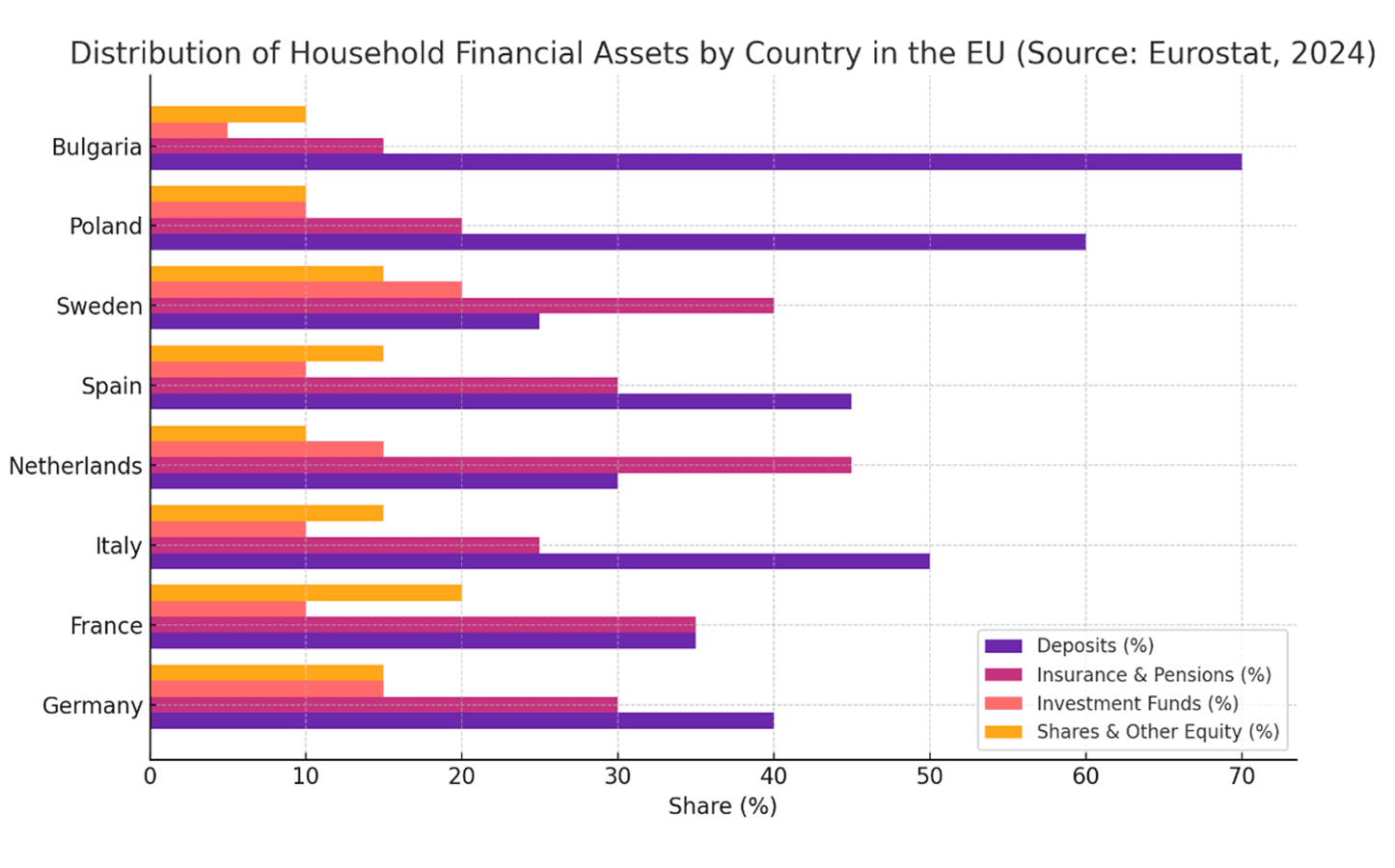

The existing investment model in the EU is fragmented and imbalanced. The dominance of low-risk, low-yield instruments in the portfolios of households and institutional investors leads to missed opportunities—not only for savers but also for the growth of the real economy. According to Eurostat data from 2024, in countries like Bulgaria (where 70% of household financial assets are in deposits) and Poland (60%), there is a noticeable lack of a culture of participation in capital markets. In contrast, countries such as Sweden and the Netherlands demonstrate higher levels of diversification, with a relatively larger share of pension and investment products.

This discrepancy is symptomatic of deeper structural and institutional barriers. The EU still lacks an integrated ecosystem that encourages the flow of capital from savings into innovative, high-risk, but also high-return enterprises. Less than 15% of venture capital in Europe is directed toward startups outside of traditional hubs such as Germany, France, and Sweden, while southern and eastern parts of the continent remain in the shadows. Private investment funds and pension institutions are also constrained in their ability to invest in risky assets due to regulatory and fiscal limitations.

The low participation of retail investors further complicates the situation. Most households are not sufficiently informed about opportunities to invest in startups or high-value-added sectors. There is also a pronounced risk aversion rooted in cultural attitudes and a historical lack of investor protection in some member states. This is supported by data from the European Commission, which shows that only about 12% of EU households directly invest in capital markets, compared to 40% in the United States.

The chart illustrating the distribution of household financial assets (based on Eurostat data, 2024) clearly highlights this lack of balance. Countries such as Germany and France show relative diversification, but even there, the share of investment funds and equities remains below 35%. In countries like Bulgaria and Poland, bank deposits dominate, further inhibiting the possibility of building a broad base of capital for startups and the transformative sectors of the future.

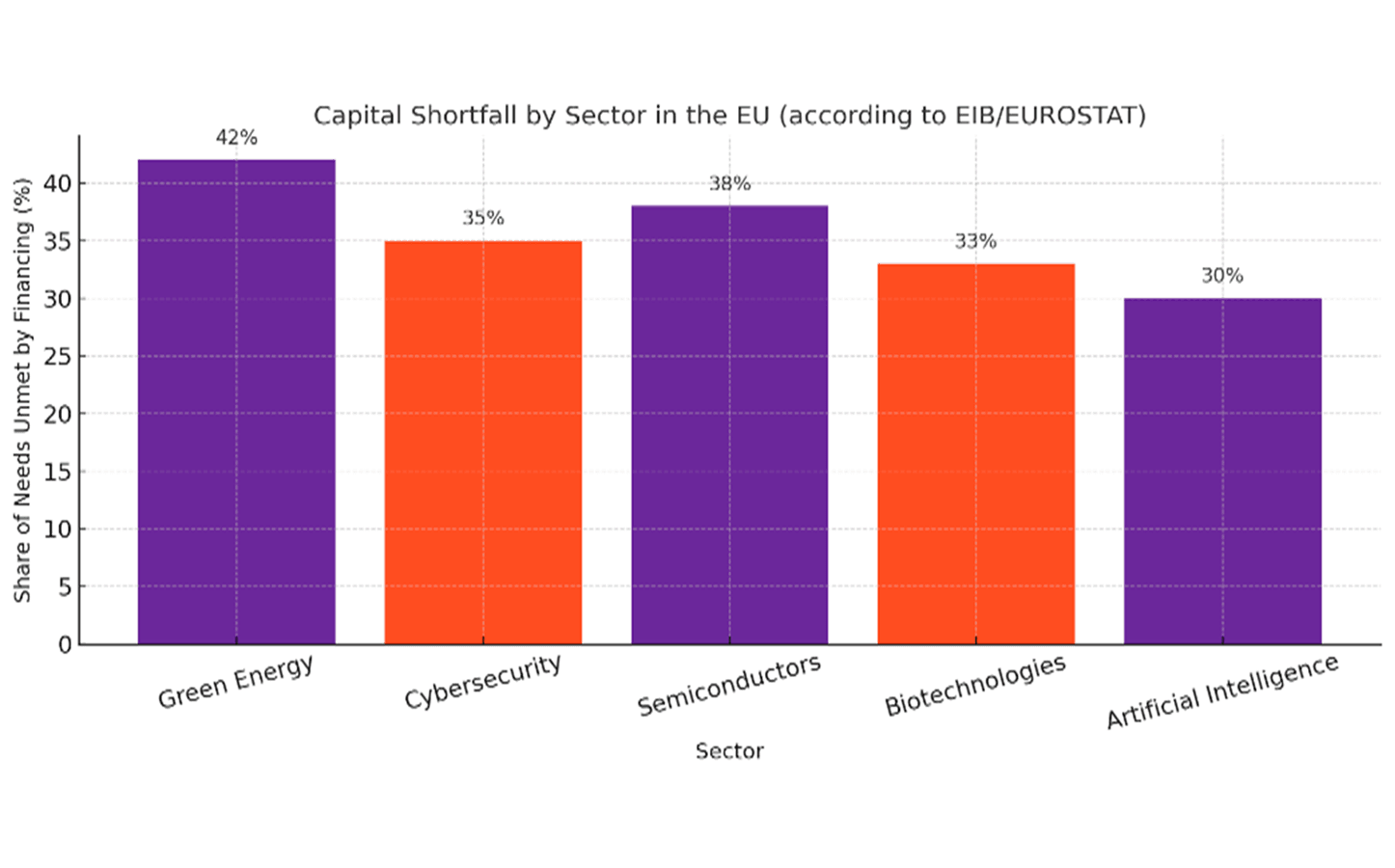

The problem becomes even more acute when analyzing the specific sectors that suffer the most from funding shortages. Data from the European Investment Bank (EIB) and Eurostat for 2024 confirm the existence of significant capital deficits, particularly affecting emerging yet critically important industries. The highest levels of capital shortfall have been recorded precisely in sectors with high innovation value: over 40% of the financing needs for green energy projects remain unmet, followed by cybersecurity (35%) and semiconductors (38%). Biotechnology and artificial intelligence-based solutions also face considerable challenges in accessing risk capital, despite their strategic importance for the Union’s future autonomy.

The causes of this shortfall are multifaceted. The limited participation of institutional investors in high-risk assets, the lack of specialized funds for long-term technologies, and the high degree of regulatory fragmentation in EU capital markets create structural barriers to financing innovation. Additionally, there is a significant information gap between investors and entrepreneurs, leading to an underestimation of the potential of innovative but riskier sectors.

And here comes the European Commission’s response:

In 2025, the European Commission is making a decisive shift toward accelerated capital mobilization by launching a new investment toolkit aimed at overcoming long-standing structural obstacles to financing within the European Union.

The creation of a European Equity Investment Platform for SMEs is among the most significant innovations. The platform functions as a digital hub, bringing together public and private sources of capital and offering a standardized framework for SME investments across the EU. It marks a new phase in the Union’s efforts to unlock the investment potential of both citizens and institutional investors by providing them with direct access to high-return opportunities in the real economy.

The platform’s core function is to establish a unified investment space where enterprises in need of funding can connect with individual and institutional investors in a transparent and trustworthy environment. At the heart of this ecosystem lie digital technologies that enable automated risk assessment, structured investment packages, and a streamlined decision-making process for investors. Instead of the traditional, complex, and costly capital-raising procedures, the platform offers a standardized framework compatible with national regulatory regimes, allowing any registered investor to allocate funds to SMEs with minimal administrative burden.

A particularly significant element is the innovative approach to risk management. Through algorithms based on machine learning and historical models, the platform performs an automatic preliminary assessment of each submitted project, classifying it by sector, development stage, innovation potential, and return profile. Based on this, investment proposals are constructed with a clear and transparent profile – including expected return, risk level, and sectoral focus – which greatly facilitates orientation for potential investors, especially for less experienced participants in the capital markets. The goal is not only to attract capital but also to create a sustainable and trustworthy environment for growth. The platform offers a low entry threshold – investments can begin at relatively accessible levels, making it open not only to institutions but also to citizens. Investors can use integrated portfolio management tools, including personalized recommendations based on risk profile, ESG preferences, or sectoral interest. These features are designed to encourage long-term participation, rather than merely one-time speculative investments.

Equally important is the platform’s close connection with the tax policy of the EU and its member states. The new regulations allow for automatic linking of certain investment actions to tax incentives – such as reduced taxation of capital gains, tax credits, or deferred taxation for long-term investing. This, in turn, further increases the attractiveness of equity financing and represents a direct response to the challenges of capital accumulation in Europe.

Another important innovation is the ESG certification integrated into the platform’s very design. Investors can see to what extent a given company or project complies with environmental, social, and governance criteria. This is particularly relevant in the context of the EU Green Deal and the broader efforts to redirect capital flows toward sustainable activities. In this way, the platform becomes both an investment tool and a mechanism for accelerating the ecological and digital transition.

Not least, the cross-border nature of the platform is of strategic importance. The ability for citizens from one country to invest easily and securely in businesses from another, without additional licensing procedures, is expected to significantly deepen the integration of capital markets within the EU. This aligns fully with the goals of the Capital Markets Union 2.0 and responds to the call for the creation of a genuine European investment market, free from barriers and restrictions.

In parallel with the creation of new equity investment platforms, the European Commission has taken a decisive step toward strengthening the Union’s strategic autonomy through the establishment of specialized Strategic Autonomy Funds. These represent new financial structures focused on directing capital flows toward industries that are not only priorities for economic growth but are also vital for the EU’s long-term sustainability, technological independence, and geopolitical stability.

The funds are based on the provisions of the Net-Zero Industry Act (NZIA), which outlines a clear framework for supporting the technologies necessary to achieve climate neutrality across the continent. Among these are solar and wind energy, green hydrogen infrastructure, energy storage systems (batteries and storage), carbon capture and storage, as well as digital cybersecurity – a sector gaining increasing importance in the face of growing hybrid threats and the digital vulnerability of the European economy.

The Strategic Autonomy Funds are financed through blended finance – a mechanism that combines public funds from the European Union, instruments of the European Investment Bank (EIB), and participation from private investors. Through this financing model, the Union is simultaneously able to channel capital toward priority areas and distribute risk among various participants, thereby lowering the barrier for private sector entry into innovative but high-risk sectors. One of the key features of this approach is the structuring of investment instruments that are both aligned with the EU’s strategic goals and attractive to the market. The creation of “first-loss” tranches by the EIB is one such example. It means that in the event of losses from a given project, the public component absorbs the initial hit, leaving the private investor in a more protected position. This guarantee-based logic has proven effective in stimulating private sector participation, especially in emerging technological industries where the predictability of returns is lower.

The goal of the Strategic Autonomy Funds is to mobilize capital and direct it in the right direction – where it will have the greatest economic, technological, and social impact. Within the framework of the NZIA, so-called strategic manufacturing capacities are defined, which should be developed within the EU in order to reduce external dependencies.

Another significant innovation is the linkage of the funds with social and regional objectives. Some of the mechanisms provide for priority investment targeting less-developed regions within the EU’s cohesion policy framework, thereby fostering sustainable growth and a more equitable territorial distribution of the benefits from economic transformation. Investments in new industries at the local level will create jobs, improve infrastructure, and help overcome longstanding socio-economic disparities between regions within the EU.

Among the most innovative financial mechanisms included in the “Union of Savings and Investments” strategy is the creation of Public-Private Co-Investment Mechanisms – instruments for joint investment aimed at overcoming long-standing structural barriers to investment in start-ups and high-value-added infrastructure projects. This approach marks a significant transformation in how investment risk is distributed between the public and private sectors and represents a key element of the EU’s efforts to promote long-term and high-risk investments in strategic areas.

At the core of this model lies the logic of the “green financial guarantee” – a concept in which public institutions take on the initial risk by securing part of the invested capital against potential losses. This allows private investors to participate in projects with higher levels of uncertainty but with the potential for substantial impact on innovation, the green transition, and digitalization. The goal is to create a favorable investment environment where capital seeks returns while simultaneously generating long-term value for society.

These co-investment mechanisms are already showing promising results through their pilot implementation within key European programs such as Horizon Europe and InvestEU. Under Horizon Europe, the European Innovation Council (EIC) employs a similar model to finance early-stage high-risk innovations by providing equity or convertible loans combined with grants. In this context, the public guarantee serves as a “signal of trust,” encouraging the participation of venture capitalists and institutional funds.

In 2025, the European Commission plans to significantly expand the scope of these mechanisms and implement their cross-border standardization. This means the mechanisms will be adapted to operate across all Member States under common rules and procedures, aiming to facilitate joint investment in transnational projects—such as building electric vehicle charging infrastructure networks, trans-European digital hubs, or interregional green industrial clusters. The goal is to overcome the fragmentation of capital markets in the EU and establish a compatible and scalable framework for mobilizing private funds in support of public objectives.

Equally important is that the new co-investment instruments will be accompanied by a transparent impact assessment system designed to track the real effects of invested resources on innovation, employment, and sustainable development. The European Investment Bank (EIB), acting as the lead implementation partner, will play a central role in executing and monitoring these mechanisms, ensuring both the financial and institutional backing of the instruments.

In the long term, Public-Private Co-Investment Mechanisms have the potential to become the foundation of a new investment paradigm within the EU—one that replaces passive redistribution with active resource mobilization, in which public and private interests are not in conflict but rather aligned in pursuit of shared European objectives. If implemented effectively, these mechanisms can not only increase the volume of investments but also expand access to capital for a new generation of entrepreneurs and innovators who will drive the European economy in the decades to come.

In its latest strategic framework, the European Commission firmly embraces fiscal policy as a tool for unlocking private capital and directing it toward economically vital projects. Starting in 2025, new tax incentives will come into force, focusing on investments in startups, green technologies, and digital infrastructure—sectors where returns can be high but where risk often deters investors.

Rather than relying solely on regulations and subsidy programs, the EU is introducing a mechanism that speaks the language of the private sector—lower taxes on capital gains and dividends for investments in innovation. This creates a logical incentive: savers and funds now have a reason to step out of the comfort zone of deposits and low-risk assets and turn toward entrepreneurship and the real economy.

Examples are already emerging. France has reported a significant increase in individual investments in SMEs following the implementation of “Madelin” tax reliefs, which allow part of the invested sum to be deducted from personal income tax. In the Netherlands, the SEED Capital model has created a sustainable environment for joint investment between the state and private funds—particularly in the technology sector.

Even more intriguing is that the Commission is working on a mechanism for the territorial targeting of tax incentives—an idea that prioritizes tax relief for investments in regions lagging in growth or access to financing. Such a policy doesn’t just inject money into the system—it directs it to where it can make the biggest difference.

Alongside these developments, Brussels is also betting on something that for years seemed like a utopia: a truly unified capital market. In 2025, the European Commission takes a decisive step in this direction by introducing a single passport framework for investment platforms—a regulatory “accelerator” designed to clear the way for cross-border investments across the Union.

What does this mean in practice? If a platform for crowdfunding, robo-advisory services, or peer-to-peer lending receives a license in one Member State, it can then operate freely across all others without facing a wall of national regulations. This is especially good news for digital platforms, which until now had to navigate cumbersome and often unpredictable procedures in each individual country. But this isn’t just about administrative simplification. The real transformation lies in the fact that European citizens—especially younger, digitally savvy individuals looking for alternatives beyond traditional banks—will gain easier access to a new type of investment. They will be able to support startups in other countries, use intelligent robo-advisors that adjust their portfolios in real time, or invest in sustainable projects through green finance platforms—all with a single click.

EU Investment Tools 2025

| Instrument | Budget / Support (2025) | Scope | Target Effect |

| European Equity Investment Platform for SMEs | €10 billion (EU + EIB + private funds) | SMEs in all growth-potential sectors | Facilitate equity access and reduce admin burden |

| Strategic Autonomy Funds (Net-Zero Industry Act) | €30 billion by 2027 | Green tech, batteries, hydrogen, digital networks | Support strategic autonomy and green transition |

| Public-Private Co-Investment Mechanisms | €15 billion (co-financing) | Startups, infrastructure, AI, biotech | Encourage early-stage funding and risk-sharing |

| Tax Incentives for Venture Capital | National tax regimes + EU recommendations | Investors in startups, green and digital assets | Boost investment activity and mobilize private capital |

| Single Passport Framework for Investment Platforms | Regulatory framework – no direct budget | Entire EU – cross-border access to fintech platforms | Democratize investments and stimulate innovation |

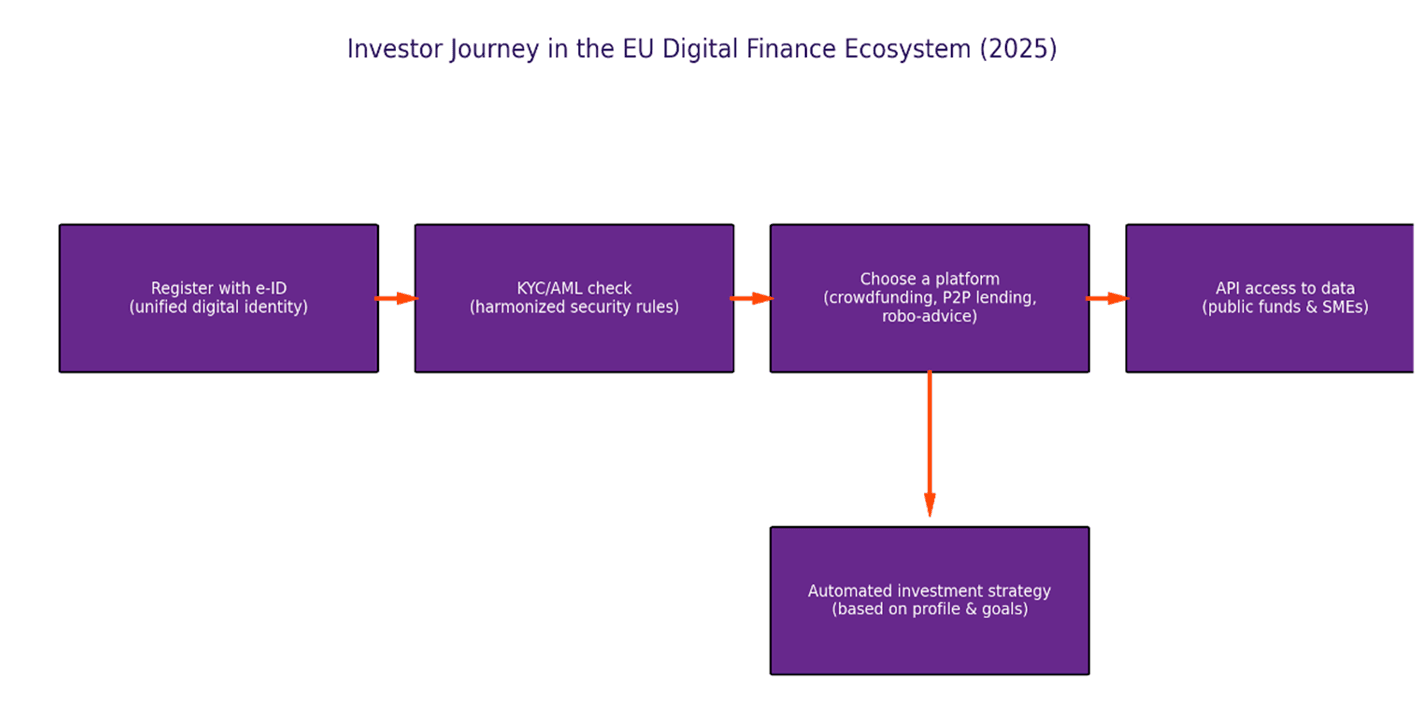

It is precisely within this ambitious vision for cross-border capital mobility that digitalization becomes not just a tool, but the core of the future European financial architecture. The European Commission is already actively working on the development of the European Digital Finance Gateway—a platform designed to digitalize access to financing in the same way that the single passport removes regulatory barriers. If the regulatory framework opens the door to cross-border activity, the portal ensures that every citizen can walk through it—quickly, securely, and with the necessary knowledge.

At the heart of this ecosystem lies the creation of a unified electronic identity (e-ID) for investors, which will replace the complex and fragmented identification procedures with a single, easy-to-use digital profile. Combined with harmonized anti-money laundering (KYC/AML) rules, this will facilitate access to investment platforms while simultaneously enhancing the security of the system. In addition, by establishing open interfaces (APIs), the portal will provide platforms with real-time access to data on public funds, available financing, and investment opportunities in small and medium-sized enterprises. This will enable the automated creation of personalized investment profiles that align with both the investor’s preferences and the needs of the real economy.

At present, the EU lags behind the United States and China in terms of public and private investment in green technologies, particularly in critical areas such as hydrogen, renewable energy sources, energy storage systems, and recyclable materials. According to the European Court of Auditors (2024), Europe must increase annual investments in green technologies by approximately €390 billion by 2030 in order to meet its climate commitments under the Green Deal and the Fit for 55 package.

The new European Strategic Autonomy Funds, backed by the Net-Zero Industry Act, are already channeling significant resources—€30 billion by 2027—and this figure is expected to exceed €60 billion by 2030 when private co-financing is included. These funds will accelerate the deployment of high-value-added technologies, support new green startups, and speed up the path to climate neutrality. At least 30% of the mobilized capital by 2030 is expected to be allocated to projects that comply with the EU’s ESG taxonomy criteria.

In the digital sector, the EU also faces notable investment gaps. According to the European Innovation and Digital Technologies Agency (EUIDA, 2025), European startups in artificial intelligence, cybersecurity, and quantum technologies currently receive only 27% of the funding they require, compared to their competitors in Silicon Valley. The creation of Public-Private Co-Investment Mechanisms is one of the tools through which public institutions will assume part of the investment risk, making these innovative—but high-risk—sectors more attractive to private capital.

According to McKinsey’s 2024 analysis, if Europe manages to double the volume of venture capital for digital startups by 2030—from the current approximately €90 billion annually to at least €180 billion—this could lead to the creation of over 4 million new jobs in technology, digital services, and infrastructure support.

One of the main objectives of the new investment framework is the creation of quality employment. The European Commission forecasts that redirecting savings toward productive investments could generate up to 7 million new jobs across the EU by 2030—half of which are expected to be in high value-added sectors such as green industry, digital technologies, scientific research, and innovation.

Cross-border investments in less developed regions will play a particularly important role in this transformation. Through the new single passport framework and equity financing platforms, opportunities are being created for the financing of SMEs in Eastern and Southern Europe, which are often excluded from traditional venture capital flows. This will contribute to economic growth and reduce regional disparities, which have been deepened by previous crises.

In conclusion, the architecture created by the European Commission is not just another economic framework. It is an invitation to co-create—a call to shape a new ecosystem where capital meets the future: green, digital, and inclusive. With its new funds, regulatory relief, tax incentives, and digital platforms, the EU is offering the tools. But the real transformation depends on us—citizens, institutions, innovators, educators, and entrepreneurs.

Beyond the numbers and strategies lies a simple but powerful choice: to remain passive observers of the global economic transformation—or to become its authors. To see our savings as a static buffer—or as seeds for future growth.

Today, Europe is not merely seeking capital. It is seeking vision, commitment, and trust. Because in a world where resources can be redirected with a single click, the most valuable currency remains the belief that the future can be invested in—and built together.

Overview of the EU Capital Markets Union 2.0 from the European Commission.

Information about the EIB’s support for strategic EU sectors, including co-investment mechanisms.

EU funding program supporting sustainable investment, innovation, and job creation.

Regulation aiming to scale EU manufacturing of clean technologies and reach net-zero industrial goals.